As you’ve owned your car for years, it’s likely starting to show its age. You may be wondering whether it’s worth keeping collision insurance, especially with rising premiums. This guide will help you understand when it makes sense to drop collision insurance for your older vehicle, balancing financial considerations with safety and risk.

The Cost-Benefit Equation: Collision Coverage vs- Your Car’s Value

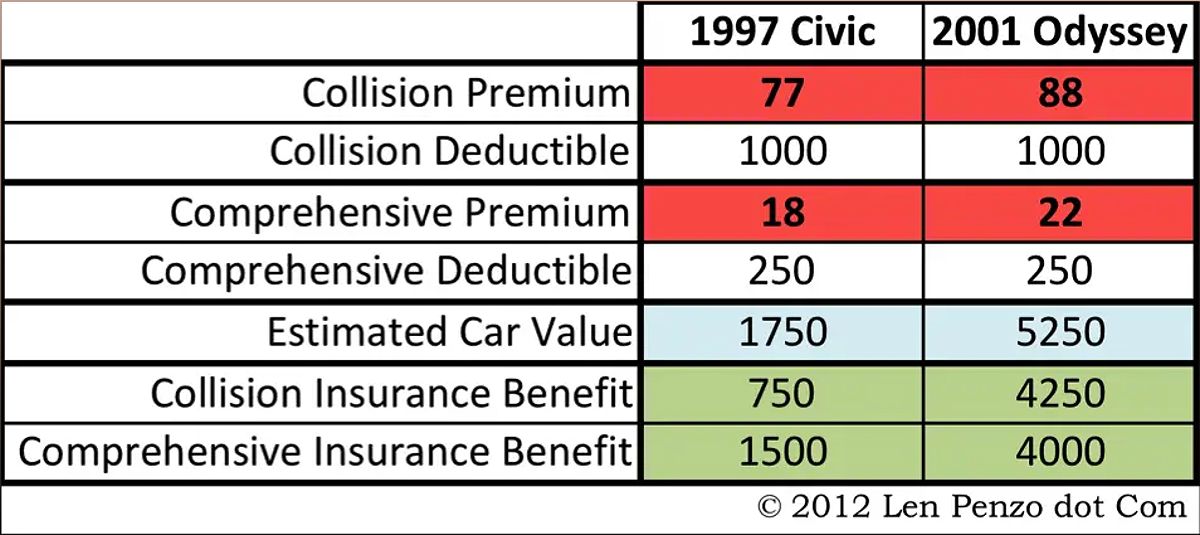

One of the primary factors to evaluate is the relationship between your car’s market value and your collision insurance premium. If your vehicle is worth significantly less than what you pay annually for coverage, it may be time to reconsider.

Your Car’s Value

To determine your car’s actual cash value (ACV), use resources like Kelley Blue Book or Edmunds. As your car gets older, its value will depreciate, and you’ll want to keep a close eye on this number. For example, a car that was worth $20,000 when new may now be valued at only $5,000 or less.

Collision Coverage Costs

The cost of your collision coverage can vary depending on your driving history, location, and deductible. Take a close look at your premium to see how it compares to your car’s value. If your annual collision premium is more than 10% of your car’s value, it might be time to reevaluate. For instance, if your car is worth $3,000 and your annual collision premium is $500, you’re paying 16.6% of the car’s value for coverage. In a case like this, it’s worth considering your options.

Calculating the Cost-Benefit

When your car’s value is significantly lower than the cost of your collision insurance, the financial benefits of maintaining that coverage may no longer outweigh the expense. It’s essential to do the math and determine if the potential payout from your insurance company in the event of an accident would be worthwhile compared to what you’re paying for the coverage.

Assessing Your Financial Situation and Risk Tolerance

Dropping collision coverage means taking on more financial risk, so it’s crucial to assess your financial situation and comfort level with this.

Financial Cushion

Having an emergency fund or savings to cover potential repair costs is essential if you decide to drop collision coverage. Honestly evaluate your ability to handle unexpected expenses without putting a strain on your finances. If you don’t have a reliable safety net, maintaining collision coverage may be the wiser choice.

Risk Tolerance

How comfortable are you with the idea of being responsible for the full cost of repairs or replacement if you’re in an accident? This is an important factor to consider when making your decision. If the thought of covering those costs out of pocket makes you anxious, it may be worth keeping the collision coverage.

Alternatives to Collision Coverage

If you’re not keen on the risk of dropping collision coverage entirely, you could consider alternatives like increasing your deductible or building a self-insurance fund. These strategies can help reduce your premiums while still providing some financial protection.

Your Driving Habits and Accident History

Your driving behavior and history can also influence the need for collision coverage.

Driving Frequency and Location

If you only drive your car occasionally or in low-risk areas, you may have a lower likelihood of needing collision coverage. On the other hand, if you’re a frequent driver or often navigate high-traffic or hazardous areas, the risk of an accident may be higher, making collision coverage more valuable.

Accident History

A clean driving record suggests a lower risk of accidents, which may make dropping collision coverage a reasonable choice. However, a history of accidents or traffic violations may indicate a higher need for this coverage, as the chances of filing a claim could be greater.

Alternatives to Collision Coverage for Older Cars

If you decide that dropping collision coverage is the right move, there are a few alternative strategies you can consider.

Increasing Your Deductible

Raising your deductible can significantly lower your premiums, but make sure you can comfortably cover the increased out-of-pocket costs if you need to file a claim. For example, increasing your deductible from $500 to $1,000 could save you hundreds of dollars per year on your premium.

Self-Insurance Strategy

Another option is to adopt a self-insurance approach, where you set aside funds in a dedicated savings account to cover potential repair costs. This requires discipline, but it can be a cost-effective alternative to traditional collision coverage. Aim to contribute a monthly or annual amount that aligns with your car’s value and the likelihood of needing repairs.

Car Maintenance and Prevention

Investing in regular vehicle maintenance, such as oil changes, tire rotations, and brake inspections, can help minimize the likelihood of accidents and costly repairs, making you feel more secure about dropping collision coverage. Well-maintained vehicles are less prone to breakdowns and are less likely to be involved in accidents.

When It’s Time to Consider Dropping Collision Coverage

Here are a few scenarios where it might be wise to drop collision coverage:

Car Value vs- Premium

If your annual collision premium exceeds 10% of your car’s value, it’s likely time to reevaluate your coverage. This scenario suggests that the cost of the coverage outweighs the potential benefits, and you may be better off self-insuring or using the savings to put toward a newer vehicle.

Adequate Savings

If you have enough savings to cover potential repair costs without financial strain, dropping collision coverage may be a viable option. This means you have a financial cushion to fall back on if an accident occurs, reducing the need for the insurance coverage.

Planning to Purchase a New Car

If you’re considering upgrading your vehicle soon, dropping collision coverage can free up funds for a down payment on your next car. This can be a strategic move, as the cost savings from dropping collision on your older car can be put towards the purchase of a newer, more valuable vehicle.

FAQ

What happens if I drop collision coverage and then get into an accident?

If you drop collision coverage and are involved in an accident, you will be responsible for covering the cost of repairs or replacement yourself. Your insurance company will not provide any financial assistance in this scenario.

Is it legal to drive without collision coverage?

Yes, it is legal to drive without collision coverage, but it may not be advisable if your vehicle is financed or leased. Lenders often require collision coverage as a condition of the loan or lease agreement.

What other types of car insurance should I consider keeping if I drop collision coverage?

Liability insurance is essential, as it covers damages and injuries to other parties in an accident. Additionally, comprehensive coverage may also be beneficial for protecting against non-accident-related damage, such as theft, vandalism, or natural disasters.

Conclusion

Deciding when to drop collision insurance is a nuanced decision that depends on various factors, including your vehicle’s value, financial situation, and driving habits. By carefully considering these elements, you can make an informed choice that aligns with your unique circumstances. Whether you decide to maintain coverage or explore alternatives, understanding the implications of your decision is crucial for effective insurance management and protecting your financial well-being.